If you want to diversify your portfolio and generate a steady income, then real estate is the most-acclaimed way of doing so. From multifamily projects to investment trusts, you have a wide-pool of options to choose from. However, given the high capital costs associated with income-generating real estate assets and the day-to-day management activities associated, some individuals are often limited to investing in small projects. For such investors, real estate mutual funds (REMFs) are a pocket-friendly option to foray into the real estate sector.

Plus, considering the growth the industry is poised to witness in the next decade, investing in real estate can turn out to be a wise decision. So today, through this blog, we will discuss REMFs in depth, including their many features and the benefits they entail.

What are Mutual Funds & How are They Different From Other Asset Classes?

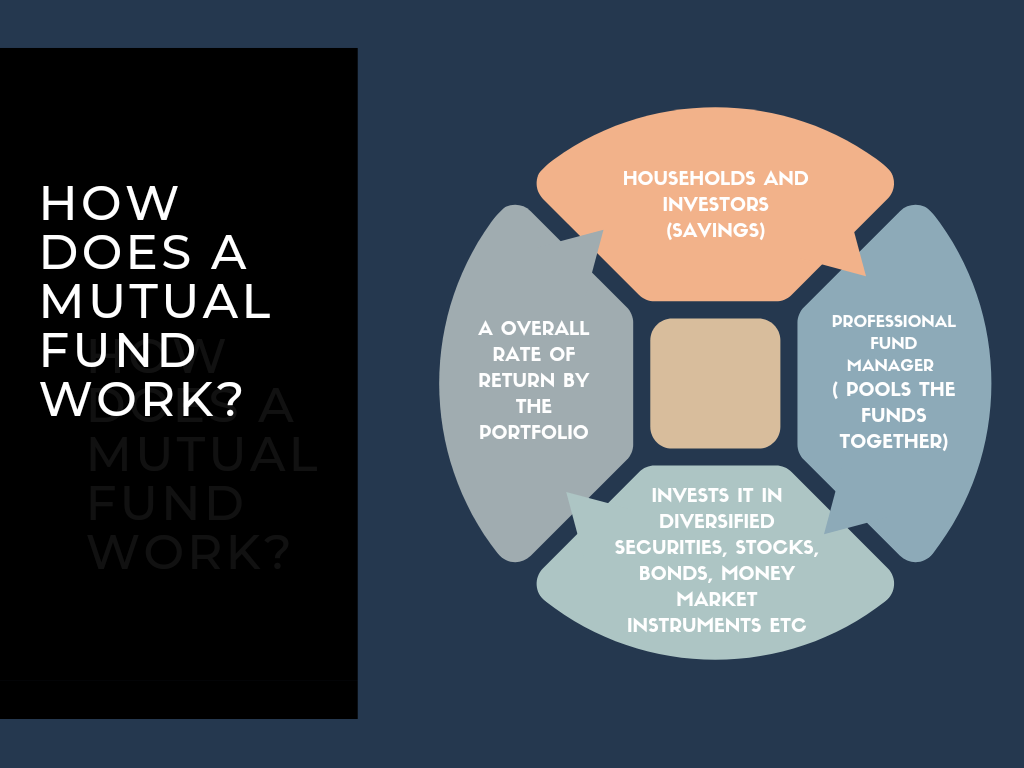

Companies often offer investors a stake in their assets through securities such as shares and bonds, which is nothing but a tradable financial asset. When multiple investors pool their money in a fund to purchase such securities, it is called a mutual fund. These funds are open-ended and are managed by professionals.

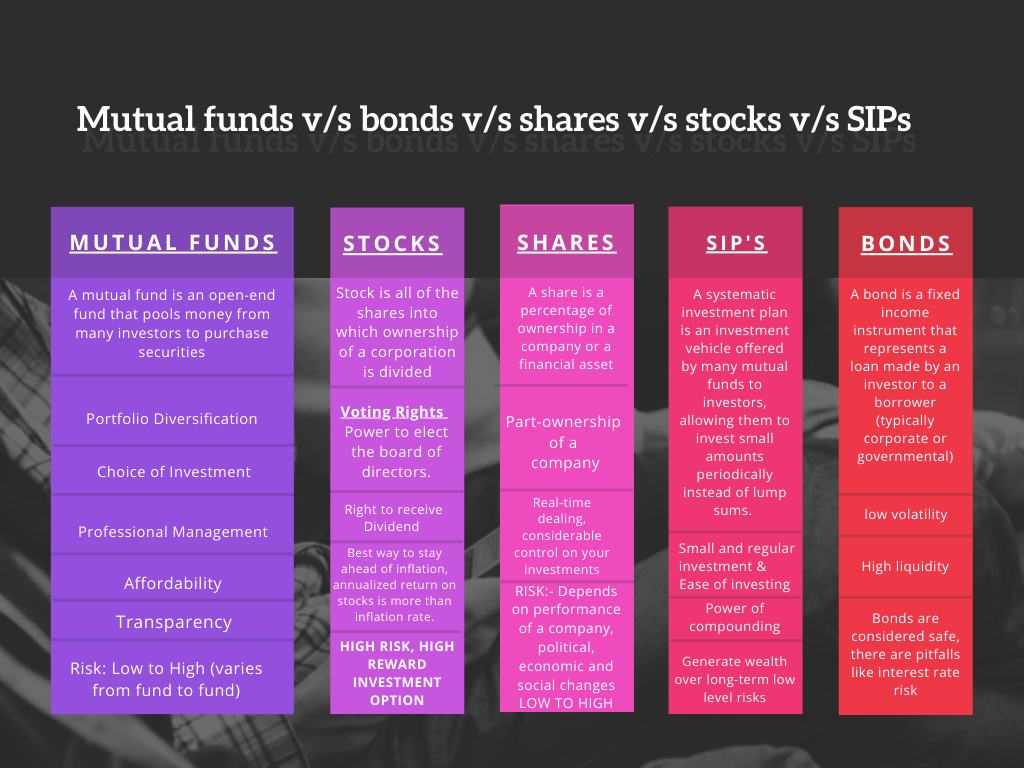

From stocks and bonds to Certificate of Deposits, there are a plethora of investment options to gain passive income. However, relative to all other alternatives, real estate is considered one of the most favourable investment classes as it provides benefits in different forms. One can either invest in a separate property or can simply pool money in a mutual fund. By either way, the benefits are immense. So before delving into real estate mutual funds, let us understand some major differences between different asset classes.

1. Stocks vs Mutual Funds

For example, comparing stocks and mutual funds based on the number of investments, risks associated, and risk management will help you differentiate between the two. Basically, investing in stocks means investing in a single company whereas investing in mutual funds means holding many investments and a great many stocks in a single fund. Since diverse stocks are pooled in mutual funds and the funds are managed professionally, the risk associated with mutual funds also minimizes.

Additionally, being traded on stock exchanges, stocks are subject to market risks such as supply and demand, economic, geopolitical, or company-specific events, and inflationary risks.

2. Bonds vs Mutual Funds

On the contrary, bonds are instruments through which an investor lends money to the company that issues the bonds. The concerned company (usually government organizations) issues bonds to raise capital for conducting various activities. Although investors don’t get any ownership in the company, they are provided with fixed returns based on the principal amount and interest rate. In mutual funds, however, interest rates are not fixed. Dividends will be high only if the market is performing well.

Given below are a few features of shares, stocks, bonds, and mutual funds that will give you a fair understanding of all the investment classes.

What are Real Estate Mutual Funds (REMFs)?

Now, when you along with other individuals pool your money and purchase securities of companies that invest in real estate projects, it is referred to as real estate mutual funds (REMFs). The investment can either be made directly in companies or in real estate investment trusts (REITs). Therefore, instead of purchasing an entire property, one can invest a small amount in an asset through REMFs and pocket in significant returns.

How Real Estate Mutual Funds Generate Returns?

When it comes to real estate mutual funds, returns are generated in two different ways: I) dividends and II) Capital appreciation i.e. an increase in the value of the units held.

| Capital Appreciation | The net asset value, which is the price per fund unit, is an important component to gauge the performance of a mutual fund. Since real estate mutual funds are invested in the securities market, the market value alters every day. Therefore, with a net increase in stock prices, the NAV of the mutual fund concerned also increases. So, by selling some of the underlying assets at higher values, investors can leverage the benefits of capital appreciation. |

| Dividends | When the mutual fund house declares the dividends, investors can use these to earn income. They can also use these dividends to invest in other mutual funds through the automatic reinvestment route. What is important to note is that mutual fund dividends are tax-free for investors. The tax is borne by the mutual fund house before distributing dividends. |

Note: One of the significant advantages of investing in real estate mutual funds is that you will receive a compounded interest. This will enhance the overall value of your investment, over time.

What are the Advantages of Investing in REMFs?

Ever since mutual funds have been made available for investors, it has become a popular real estate investment source. It has especially become beneficial for those who don’t have a large amount of capital to invest in large-scale real estate assets. Enlisted are some of the advantages of pooling your money in real estate mutual funds.

1. Feasible Alternative & Investment Flexibility

Investors, particularly those who do not have a huge capital flow, find it difficult to invest in real estate assets like commercial or residential properties. So one of the advantages that make real estate mutual funds a popular investment vehicle is the flexibility it offers. You can invest in different types of securities based on your financial goals and income capacity. Therefore, not only is the initial investment low, but you can also cash in on your investment anytime.

2. Professionally Managed Services

Investing in the share market on your own can be a cumbersome process, especially, if you lack professional knowledge. That is when you may need someone to guide you through the process to ensure safe and secure investments. Real estate mutual funds are managed by professionals (fund managers) who invest them after conducting thorough market research and analyzing the market sentiments.

This is not possible in physical assets as there, investors would have to manage day-to-day activities individually.

3. High Liquidity & Hedge Against Inflation

While investment flexibility is one aspect, liquidity is another facet when we talk about different types of real estate investments. The reason why properties are less liquid is that reselling them can take quite a long time. Real estate mutual funds, however, can be liquidated whenever you want to.

The property price, as well as the rents accrued, appreciates when an economy goes through an inflationary phase. This increases the value of a property, which, in turn, leads to an increase in the value of REMF units. Hence, these investment instruments act as a hedge against inflation.

4. Diversification

From rental properties to hospitality projects, these funds are an excellent option for individuals who want to foray into the real estate sector. Even with limited capital availability, you can invest in wide spectrums across the sector. For example, the fund may specifically focus on multifamily assets or alternatively, the investment can be made in different types of commercial spaces.

5. A Stable Portfolio

Stability in investments and balanced risk are the most attractive benefits of real estate mutual funds. The REMF is a pool of numerous real estate assets with low to moderate-level overall risk. Unlike stocks, where the slightest market flotation can change the prospects, the risks associated with REMFs are minimum. Plus, the fund manager has the choice to withdraw the investments as and when the market conditions seem viable.

What are the Risks Associated with Real Estate Mutual Funds?

While real estate mutual funds come with their own set of benefits, there are also certain risks associated with these investment vehicles. Let us understand these concerns through the following pointers:

“Mutual fund investments are subject to market risks”—a statement that you must have heard time and again. When the real estate industry in India is reeling under a crisis or when interest rates go high, you will witness a downfall in the yields. However, when the sector performs well, the funds will benefit too.

When you invest in real estate mutual funds, you are not at liberty to decide which asset the money should be pooled in. The ultimate decision lies with the company management. They may either foray into commercial real estate or may decide to invest in residential properties. Hence, execution issues are also prevalent in such funds.

List of Real Estate Mutual funds In India

1. Aditya Birla Sun Life Global Real Estate Fund

It’s a pool of funds scheme investing predominantly in Global mutual funds that invest in real estate securities, and ideally designed for those who are looking for long term capital appreciation. As far as the eligibility is concerned, the scheme shall have a minimum of 20 investors and no single investor shall account for more than 25% of the corpus of the said scheme.

2. HDFC NIFTY Realty Index Fund

HDFC Mutual fund has recently launched an open-ended scheme, which is also India’s first mutual fund scheme that would focus on the domestic realty sector. The biggest advantage of this fund is that it offers the investors an exposure to a diversified portfolio of real estate stocks. However, through a single instrument, removing the need for selecting individual stocks.

3. Small & Medium REITs

SEBI recently notified its rules regarding REITs, and the changes are designed to include smaller and medium-sized REITs, referred to as SM REITs, which are aimed at making it easier for these entities to be part of the real estate sector via fractional ownership of commercial and residential properties. Previously, at least 500 crore was needed for REITs to operate. However, with the new amendments, REITs can start with an asset value of just Rs 50 crore. This move opens up new opportunities for investors, especially smaller ones, to enter the commercial real estate market through REITs with lesser investment requirements.

4. JM Real Estate Funds

Managed by JM Financial Asset Management Ltd, aims for capital growth by investing in both development projects and completed residential properties in India’s Tier 1 and Tier 2 cities. Given its focus on the residential sector and involvement in development projects, the fund carries a moderately high risk. Investors can start with a minimum investment of Rs. 5,000. The fund primarily invests in projects by renowned developers such as Oberoi Realty, Godrej Properties, and Prestige Estates Projects.

How are REITs Different From Real Estate Mutual Funds?

Conceptually, both real estate investment trusts (REITs) and REMF are the same. These investment vehicles collect money from an array of investors, pool them, and then invest in numerous assets. However, there are a few differences that you must know of.

| Categories | REIT | REMF |

| Definition | REITs are associations or firms that own, manage, and operate income-generating properties i.e. they directly invest in real estate assets. | Real estate mutual funds, on the other hand, invest in REITs or securities of real estate investing companies. |

| Volatility | REITs are traded on stock exchanges and are thus volatile. A slight change in market sentiments can affect the yields. | REMFs are a pool of securities. So even if one of them is not performing well, it doesn’t make the REMF very volatile. |

| Objective | REITs manage a pool of income-generating assets, which means that the investors earn a rental income on a regular basis. | The primary objective of investing in REMFs is to benefit from capital gains or price rise. |

Real estate mutual funds, therefore, are liquid investments that offer good yields at the end of term-end. It is the most suited investment option for those who have sufficient knowledge of the sector but are running low on budget. However, just like other types of funds, REMFs also come with their share of risks and rewards. Hence, you should consider all factors before pooling your funds in this investment instrument.

![Top Real Estate Companies in Hyderabad [2024 Latest List] Top Real Estate Companies in Hyderabad](https://www.propacity.in/blog/wp-content/uploads/2024/04/Top-Real-Estate-Companies-in-Hyderabad-218x150.jpeg)

![Top Real Estate Companies in India [2024 Latest List] Top Real Estate Companies in India](https://www.propacity.in/blog/wp-content/uploads/2024/04/Top-Real-Estate-Companies-in-India-218x150.jpeg)