MCLR (Marginal Cost of Funds Based Lending Rate) is the minimum limit within which commercial banks cannot lend to their borrowers. This becomes the internal marker for these banks to help them set interest rates on various loans.

As a homebuyer, you take several things into account when looking for an ideal home. This includes but is not limited to, neighbourhood, physical infrastructure, security, and property documents. Additionally, if you are applying for a home loan, then you would compare the interest rates of different banks. After all, who doesn’t want to benefit from lower interest rates. But as a borrower, you must know that in 2016, RBI replaced the base rate with the MCLR rates. This was done to pass the benefits of reduced repo rate to the borrowers.

You probably are left wondering what is base and repo rate and how is it related to MCLR. Don’t worry! Today, through this guide, we will explain what is MCLR rate and how it affects your home loan.

What is MCLR Rate?

The MCLR Rate is the minimum rate below which the commercial banks cannot lend to its borrowers. It acts as an internal benchmark for the banks to set interest rates for different types of loans. The primary objective of introducing MCLR was to transfer the benefits of repo rate cuts to the borrowers. So as soon as the repo rate is slashed, the floating interest rates (fluctuates with market variations) on home loans also reduce. MCLR came into force on 1st April 2016 when RBI replaced the erstwhile base rate.

Additionally, the RBI has mandated the lenders to publish overnight, 1 month, 3 months, 6 months, 1 year, 2 years, and 3 years MCLR rates on a monthly basis.

Note: Banks can even lend at a rate lower than the MCLR in exceptional cases. However, to do this, lenders have to take prior permission from the RBI.

Important Terms Before Understanding What is MCLR Rate

Before delving deep into the concept of Marginal Costs of Funds Based Lending Rate, there are a few terms that you need to know of. Some of these definitions have been tabulated below:

| Terms | Meaning |

| Repo Rate (RR) | It is a rate at which commercial banks borrow from the Reserve Bank of India (RBI). In 2024 currently repo rate stands at 6.5% which is unchanged since Feb 2023. |

| Bank Spread | The difference between interest rates imposed on the lenders and the IR that banks pay their customers/depositors. |

| Base Rate | As the name suggests, the base rate is the minimum value set by the central bank of India i.e. RBI, below which banks cannot lend to their borrowers. |

| Cash Reserve Ratio (CRR) | Banks are supposed to keep a specific amount of cash as reserves with the central bank. This minimum value is known as the cash reserve ratio. As per the norms set by the RBI, banks have to maintain 4% of Net Demand and Time Liabilities as CRR. |

| Statutory Liquid Ratio (SLR) | The minimum % of deposits which the institutional lenders have to keep as reserves in the form of liquid cash, gold, or securities is called Statutory Liquid Ratio. |

Why was the Base Rate Replaced with MCLR?

Now that you have understood what is MCLR rate, let us go through the reasons why the RBI introduced it. Before MCLR came into force, institutional lenders set base rates as per their own calculations and at their own discretion. While some computed the minimum rate based on marginal costs of funds, others preferred the average cost of funds. In addition to this, the benefits introduced by altering the monetary policy i.e. interest rates were not handed down to the customers by the banks. Hence, there was no uniform system to define the minimum interest rates on loans. To bring a transparent and uniform methodology for computing minimum rates for loans, the RBI introduced MCLR in August 2016.

Difference Between MCLR and Base Rate

After understanding what is MCLR rate and going through the reasons of why RBI introduced the concept, let us take a quick look at the key difference between MCLR and Base Rate.

| Criteria | Base Rate | MCLR |

| Introduced | 2010 | 2016 |

| Loan Tenure | Loan tenure not taken into consideration | Tenor premium is an important metric to compute MCLR |

| Rate Published | Quarterly | Monthly |

| Repo Rate Benefits | Not passed down to the borrowers | Benefits are passed onto the borrowers |

| Computation Factors | Cost of deposits, avg. return on networth, bank’s operational costs, negative costs of carry. | Tenor premium, marginal costs of funds, operational costs of banks, costs of maintaining SLR and CRR |

How is MCLR Calculated?

While understanding what is MCLR rate theoretically is easy, putting it to the application can be a tad difficult. In practice, the MCLR calculation is based on 4 factors:

| Factors | Meaning | |

| A | Marginal Costs of Funds | The banks borrow from multiple sources, each having different interest rates. This includes, but is not limited to fixed deposits, current and savings accounts, equity, etc. The marginal costs of funds are calculated by taking into consideration the interest rates of all the borrowing sources. |

| B | Tenor Premium | When a loan is taken for a long period, the risks associated with it are also high. Hence, to cover the risk, the lending institutions transfer the load on to the borrowers. This is done by charging a premium, which is known as Tenor premium. |

| C | Bank’s Operational Costs | As the phrase suggests, operational costs on banks are the total expenses incurred on raising the funds. |

| D | Negative Carry on account of CRR | When the return on the cash reserve ratio is nil or is less than the actual cost of funds, it is referred to as the negative carry on the account of CRR. |

Hence, to put it simply, MCLR = A + B + C + D

What is EBLR and Why is it Important?

The MCLR linked loan system was introduced to pass the benefits of repo rate cuts to the borrowers. Although this was a step taken in the right direction, the loan borrowers could not benefit much as the institutional lenders did not pass the benefits generously. To end the disparity, the RBI in 2019 mandated banks to link home, auto, and MSME loans with the External Benchmark Lending Rates (EBLR). The banks had the option of choosing between any of the 4 below-listed EBLR mechanisms:

- Repo Rate

- 91-day Treasury Bill

- 182-day Treasury Bill

- Benchmark interest rates set by the Financial Benchmarks India Pvt. Ltd

Note: The EBLR linked loan mechanism is only applicable when you are availing loan from a bank and not a Non-banking Financial Institution (NBFC). Additionally, in order to switch to the EBLR system, you will have to submit migration charges along with some taxes.

How MCLR Affects Home Loan?

When we try to understand what is MCLR rate, it becomes important to evaluate its impact on the home loans. Enlisted are a few points that you must understand before proceeding further.

- MCLR is only linked with home loans issued on floating rates and not those which are offered on fixed rates. Home loans and loans against a property are some examples of loans linked with floating rates.

- Floating rates further depend on spread on the benchmark rate and reset period. These metrics are combined to compute the interest rates on your home loans.

| For example, a bank XYZ has fixed ‘spread’ at 0.3% and MCLR (1-year) at 8% Therefore, Interest Rate = Spread + MCLR Interest Rate = 0.3% + 8% = 8.3% |

- In addition to this, only those borrowers who applied for home loans between 1st April 2016 and 1st October 2019 can avail of the benefits of MCLR linked home loans.

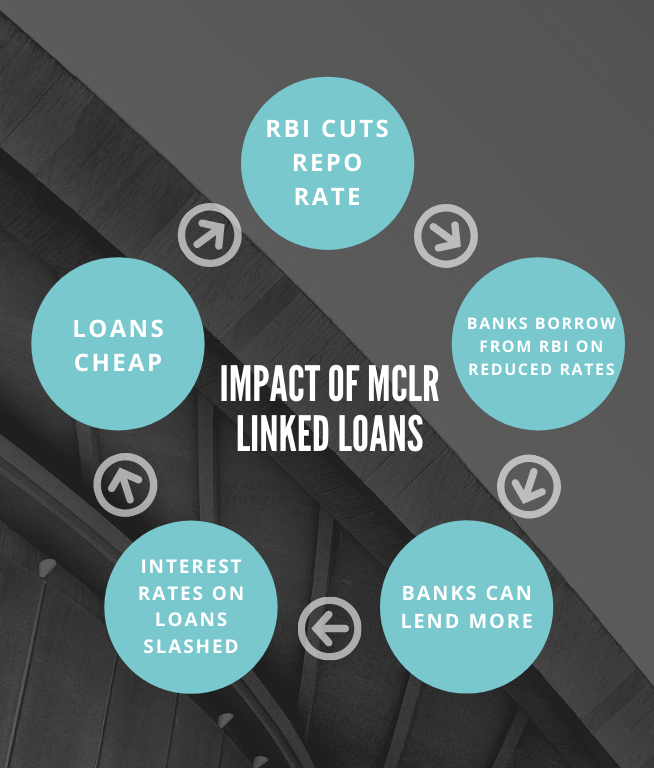

As we know, MCLR is linked with repo rate and when RR is reduced, the impact is directly seen on the interest rates on home loans. The image given below explains the MCLR linked home loan process.

Now here is the catch.

When a bank reduces the MCLR, the impact of MCLR is not seen immediately. This is due to the presence of the “reset-period” clause in the system. To put it simply, the interest rates are reset generally after a 6-month or 1 year period. So if the bank reduced MCLR in March 2021 and your reset period is in March or April 2021, then you will reap the benefits of the cut. However, if your reset period is set in January 2021, you will get the benefits only after a year i.e in January 2022.

FAQs

- What is Overnight MCLR?

What is MCLR rate and how is it related to overnight MCLR is a question that bothers many. With the implementation of MCLR in 2016, the RBI has mandated the banks to review and revise MCLR rates for different periods i.e. overnight, 1 month, 3 months, 6 months, 1 year, 2 years, 3 years.

- What is Loan-to-Value (LTV) Ratio?

Before approving or denying a home loan to a borrower, the lending institutes assess the risks associated with it. For this, the Loan-to-value ratio is taken into consideration. LTV is nothing but the proportion of the total property value that can be financed by lenders. As per the norms set by the RBI, the formula for calculating LTV is-

LTV Ratio (%) = Total amount borrowed/Value of the property x 100

- What are some current MCLR rates from top banks?

Currently, MCLR rates stand at 8.75%, SBI at 8.75%, HDFC at 8.80%, and Axis at 9.90%. Borrowers should look into the bank’s official site to keep themselves updated with the latest rates.

- What is the difference between MCLR and repo rate?

MCLR (Marginal Cost of Funds Based Lending Rate) is the minimum limit within which commercial banks cannot lend to their borrowers. This becomes the internal marker for these banks to help them set interest rates on various loans.

Repo Rate is the rate at which banks can borrow from the RBI. The benefits of the repo rate cut shall be passed on to the borrowers as well, because MCLR is very much influenced by the repo rate.

- Is MCLR also connected to the home loan interest rates?

MCLR influences the interest rates of housing loans as a reference pricing tool that helps banks fix their lending rates. With the repo rate going down, the MCLR also decreases, meaning the consumer will get lower home loan interest.

- What is the schedule for adjusting MCLR rates?

MCLR rates are updated monthly and can be obtained for overnight, 1 month, 3 months, 6 months, 1 year, 2 years, and 3 years periods.

- Can banks lend at a lower rate than based on MCLR?

Yes, banks have the right to lend at rates that are lower than the MCLR, but they must get the RBI’s approval beforehand.

- The meaning of the reset period in MCLR-linked loans is:

The reset period means that the rate of interest on MCLR-linked loans is recalculated fresh, based on the current MCLR rates. It takes 6 months or 12 months.

- How does the LTV ratio (LTV) influence approvals of a home loan?

The LTV ratio is indeed an important consideration that a bank makes when granting a home loan. It shows how much property value can be financed by the lender. A heightened LTV ratio can often lead to being offered a higher interest rate.

- Does the MCLR affect the real estate market as well?

Generally, MCLR has the ability to affect the real estate market by influencing the change in interest rates on housing loans. Lower MCLR rates can make home loans more affordable, which can, in turn, increase demand in the construction sector.

Hopefully, through this comprehensive guide, you have now understood what is MCLR rate, its significance, and its impact on home loans. It brings respite to borrowers as the benefits of lowered interest rates will now be passed onto you. However, that’s possible only when your home loan is based on floating rates.

![Top Real Estate Companies in Hyderabad [2024 Latest List] Top Real Estate Companies in Hyderabad](https://www.propacity.in/blog/wp-content/uploads/2024/04/Top-Real-Estate-Companies-in-Hyderabad-218x150.jpeg)