REITs and InvITs are two investment instruments, These allow investors to put money into public companies that manage commercial Real estate properties and Infrastructure, these companies are public traded and listed in stock exchange.

InvITs are new investment options recently started in India in 2014 (Announced by SEBI), Unlike REITs that manage commercial properties, InvITs are focused on infrastructure projects, like bridges, roads, power plants, tunnels etc, these public companies are like mutual funds for infrastructure sector, and if company performs well it provides regular dividend to the investors.

In this article, we will discuss REITs and InvITs, their differences, investment processes, types, and other essential details.

What are REITs and InvITs?

Companies that finance, purchase, or manage commercial spaces that have the potential to generate an income are referred to as Real Estate Investment Trusts (REITs). It is a legitimate way of investing in the real estate sector as you can get enlisted in the stock exchanges. While the idea of REIT was conceptualized by the Securities and Exchange Board of India (SEBI) in 2008, it was only in 2019 when India’s 1st REIT—The Embassy Office Parks—raised its Initial Public Offering (IPO). Mall, shopping complexes, hotels, co-working spaces, and hospitals are some of the most suitable examples of REITs.

On the other hand, the Infrastructure Investment Trusts (InvITs) are vehicles that allow the investors to pool their capitals in the infrastructure sector and hold income-generating assets. Roads, highways, power, gas pipelines, energy projects, etc. are some of the major examples of InvITs. IndiGrid and IRB are some of the registered InvITs.

The common thread that links REITs and InvITs is that they both are regulated by the SEBI and both are listed and traded on stock exchanges.

What is the Importance of REITs and InvITs?

According to a report published by IBEF, India requires Rs 50 Trillion by 2025 for long-term sustainable growth. However, due to the scarcity of funds and longer gestation periods, the responsibility of providing long-term capital investment rests with commercial banks.

- Although at nascent stages, the introduction of infrastructure (InvITs) and real estate investment trusts (REITs) in India has enabled the project developers to monetize their financial resources by bringing multiple assets under one unit.

- These investment trusts provide a degree of liquidity, stable yields, and reduce the financial burden on domestic banks.

- REITs and InvITs open an income-generating avenue for real estate developers and infrastructure project owners

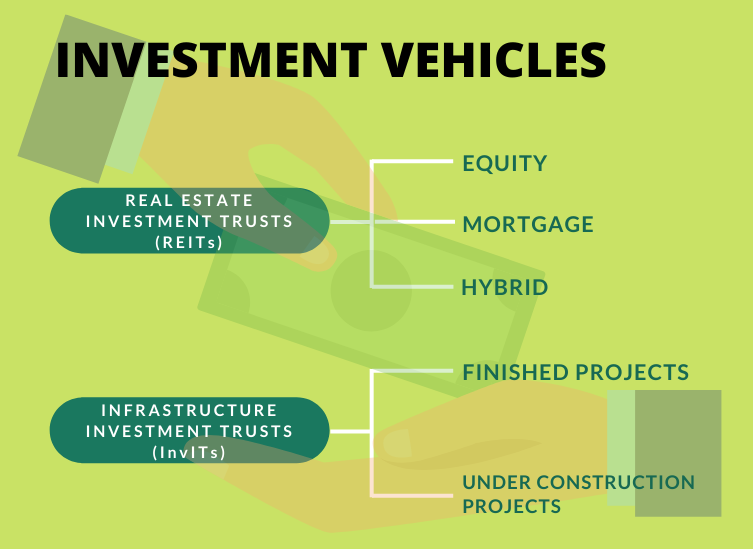

Types of REITs and InvITs

The first major difference between REITs and InvITs is with respect to their sub-categories. REITs are broadly categorized into 3 categories—Equity, Mortgage (mREITs), and Hybrid REITs. While Equity REIT companies own, manage, and rent out income-generating commercial projects, mREITs finance projects capable of generating income. Hybrid REITs, on the other hand, generate income from both rents and interests accrued from mortgage loans.

Based on the types of projects, the Infrastructure investment trusts are bifurcated into 2 categories—Finished projects and under construction projects. Companies that invest in completed infrastructure projects through IPOs fall in the former category. While in the latter, investments are made through private entities.

REITs vs InvITs: Structure

Although the elements in both the trusts have almost similar roles, there are some differences in terms of activities. The structure of REITs and InvITs have been tabulated below:

| Components | REITs | InvITs |

| Trustee | Registered with SEBI. Holds assets for REITs, and for the benefit of holders. | Registered with SEBI. Holds assets for InvIT, and for the benefit of holders. |

| Sponsor(s) | 1. Net worth: Rs 100 Crore 2. Hold not more than 5% of total units 3. Appoints trustee | 1. Net worth: Rs 100 Crore. 2. Hold 15% of total InvITs |

| Manager | Operational responsibility | Company, LLP, Body Corporate Handles the day-to-day activities of the trust |

| Valuer/Project Manager | Technical asset and financial valuation | Company, LLP, Body Corporate. Implements and oversees assets held by the trust. |

Pros and Cons of REITs and InvITs

To make your decision process efficient, we have highlighted some of the advantages and disadvantages of investing in REITs and InvITs below.

REITs

- Provides a stable income source

- A legitimate way of investing in the real estate sector

- Assets are liquid

- Prone to market-linked fluctuations

- Not much tax benefits

InvITs

- Diverse investment portfolio

- The best alternative for generating fixed income

- Assets are managed professionally

- Prone to inflation-related risks

- A small change in regulatory or tax laws can bring massive changes

- Delay in returns due to a long gestation period

REITs and InvITs: Key Takeaways

| Metrics | REITs | InvITs |

| Subscription amount | Minimum Rs. 2 lakh/per applicant | Minimum Rs. 10 lakh/per applicant |

| Allotment value (initial offer) | Rs. 50,000 | Rs. 1 Lakh |

| Regulatory risks | Less prone | More prone to it |

| Liquidity | Lower unit price and trading lot, therefore more liquid | Bigger trading lot, therefore less liquid |

| Income stability | Since 80% of assets are income-generating, REITs offer better income stability | Depends on multiple factors like tariff scalability and capacity usage |

InvITs: Prominent Examples of InvIts in India

In Recent years the financial market has witnessed the rise of REITs in India and now InvITs offer investors another lucrative investment option. As the Indian economy gains momentum in the pursuit of growth, quality infrastructure provision and commercial real estate projects.

These new Infrastructure trusts give opportunities for investors to pool their capital and undertake commercial investments in the fields of the real estate and infrastructure sectors.

InvITs therefore provide investors an opportunity to earn profits from the rise of infrastructure development in the country.

There are several notable InvITs operating in India across different Infra sectors that investor should be aware of. Some of the prominent InvITs include:

PowerGrid Infrastructure Investment Trust (PGInvIT)

PGInvIT is a leading Infrastructure Investment Trust focused on the power transmission sector in India. Sponsored by Power Grid Corporation of India Limited (PGCIL), the country’s largest transmission utility, PGInvIT owns and operates five inter-state power transmission assets.

IRB Infra Fund

In the road infrastructure space, IRB Infra Fund is a major InvIT that has attracted significant investments, including a notable 24% stake acquisition by Ferrovial subsidiary Cintra from GIC.

This acquisition highlights the trust’s growing investor base and future growth potential.

Also IRB Infra Fund stands a good chance of benefiting from the ongoing infrastructure development in India, especially in the critical road sector which not only improves domestic and international trade but also is of critical importance.

It is expected to provide contribution to the country’s infrastructure expansion through this sector as well as a steady and growing stream of income for investors.

India Grid Trust

India Grid Trust (IndiGrid) is a Power Sector InvIT established in 2016 and sponsored by KKR & Sterlite Power. Registered with SEBI, it focuses on owning power transmission and renewable assets.

IndiGrid’s portfolio includes 14 operating projects with over 7,570 kms of transmission lines and 13,550 MW of transformation capacity.

This publicly listed trust has made significant acquisitions, including holding stakes in Parbati Koldam Transmission Co. Ltd., FRV solar farms, and NER-II Transmission Ltd. in the largest single asset deal in India’s transmission sector.

With a workforce of 700 employees, IndiGrid is led by CEO Harsh Shah, CFO Jyoti Kumar Agarwal, and Independent Director Jayashree Vaidhyanathan, among others. The trust’s performance is closely tied to India’s economic and infrastructure growth trends, particularly in the power transmission and renewable energy sectors.

REITs and InvITs are excellent long-term income-generating vehicles. However, you should factor in metrics like funds from operations, leverage ratio, credit ratings, capital cost, etc before investing in either of the two entities.

![Top Real Estate Companies in Hyderabad [2024 Latest List] Top Real Estate Companies in Hyderabad](https://www.propacity.in/blog/wp-content/uploads/2024/04/Top-Real-Estate-Companies-in-Hyderabad-218x150.jpeg)